Investment Highlights

Desirable location – just minutes from Manhattan ‘Blue chip’ location – similar to investing in London in the UK High rental yields – typically 10% – 13% net pa Estimated price growth – 7%+ pa for the next 5 – 10 years Strong rental market – many Americans migrating to New York Multiple investment strategies – choice of buy-and-hold or medium term exit Booming economy – massive regeneration in area

With more than 8.2 million people, New York City (NYC) is the most populous city in the USA. The ‘Big Apple’ is one of the world’s leading business, fi nancial and cultural centres and the city boasts a high quality of life and high household incomes. With over 200,000 businesses, NYC has one of the world’s most highly-developed and integrated economies. New York is home to 53 Fortune 500 companies, more than any other region in the USA. It is a global hub of international business and commerce and one of the three command centres for the world economy along with London and Tokyo. As a result, many international corporations are headquartered in Manhattan. NYC accounts for almost 10% of the USA’s entire GDP and a report from McKinsey Global Institute predicts New York City will rank number one in the world for GDP in 2025.

About Jersey City

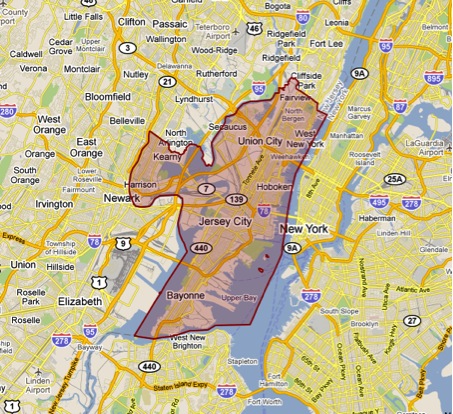

Jersey City, NYC, is just across the Hudson River from Manhattan. The area has direct rail, road and water transport links to Manhattan, offering fast commuter access to the central hub of New York. The rail time commute from Exchange Place in Jersey City to the World Trade Centre station in Manhattan is only 8 minutes!

The state’s “hottest market”

Jersey City is the second most populous city in New Jersey with almost 250,000 residents and circa 630,000 in the entire state metro area. The popularity of the area is due to its close proximity to Manhattan and Jersey City is now cited as “the state’s hottest market.” [Source: Thomas DeGise, chief executive offi cer of county government.]

Massive residential demand

Residential markets are particularly hot in the area, especially among upscale professionals who want to live near their New York jobs and those looking for convenience and proximity to world-class cultural centres (without the Manhattan price tag). In fact, it is predicted 85,000 new properties will be required to keep up with booming demand within the next 25 years. [Source: New Jersey Business magazine.]

Construction, regeneration and investment

Jersey’s ideal location and close proximity to New York City has also contributed to the development of its own impressive skyline. This includes the Goldman Sachs building, one of the tallest buildings in the world and the development of New Jersey’s HarborSpire, a partnership between local developer Joe Panepinto and the Trump organisation.

Booming ‘blue chip’ economy

Jersey City’s economic sphere is also one of the fastest growing, as Fortune 500 corporations including Chase Manhattan Bank, Lehman Brothers, Merrill Lynch, Charles Schwab and others continue to bring their business to the area.

A professional society with disposable income

The entire Jersey City Metro (Hudson County) has a total area of 62 square miles, with a population of circa 630,000 residents (250,000 of these in Jersey City alone). This is a predominantly young adult population, aged between 25 and 34 years. The large majority of these are upscale professionals who want proximity to their New York jobs and worldclass cultural centres. According to the Hudson County Economic Development Corporation, 65% of households have no children under the age of 18 years.

Generous, stable and consistend rental yields

In most areas of Jersey City Metro, residential property prices have declined circa 30% from their 2006/2007 peak. Despite the fall in prices, residential property rents in Hudson County have remained robust throughout the market downturn and been broadly stable from 2006/2007 to present day. When considered against the declines in capital values, this has boosted further the profi table rental yields which attract property investors to the area.

Typical Property Below – these are purely properties our partner purchases from the Bank. For Updated List please email info@knightsbridgeinternationalinvestments.com or call me +1 917 902 5160

Recently Sold Property / Financial Breakdown below -

Purchase Price $155,000 . Net Yield 12.1%

Why Jersey City?

Jersey City is a city in Hudson County in the New York Metro Area. What makes Jersey City

attractive to a homeowner and renters is the close proximity to NYC without the cost. Jersey

City is divided into the following areas, Jersey Heights, Journal Square, Downtown,

Bergen-Lafayette, Greenville and West Bergen.

The rental market has remained strong with continual growth. There is a huge demand for affordable rental units. Also, with the inception of the Hudson Light Rail, commuting to NYC or to the Jersey City Business District has never been easier. In studies done by several States with a Light Rail System, the cities have seen a steady growth in population and a projection of a 50% growth in 10 years.

The collapse of the American mortgage market has produced an

extraordinary once in a lifetime investment opportunity. As we have all read about, the banks were forced to increase their capital requirements and enforce strict mortgage lending criteria which resulted in millions of foreclosures as owners could not refinance and home values went under water dramatically across the whole of the USA.

Faced therefore, with extreme negative equity on their properties,

millions of US homeowners opted for bank foreclosure (repossession), rather than face the

prospect of many more years of negative equity as poor credit histories in the US can be

totally removed after just three years. This shift away from home ownership ( at its peak it was 69%) has meant a shift towards rentals, driving up rents and thus yields, as millions of

ex-homeowners sign up as tenants. Even Hedge Funds are now buying bulk purchases of multi family homes for their portfolios